Tips for First-Time Homebuyers in Brantford

Being one of the many first-time homebuyers in Brantford can feel like stepping into a whole new world—one filled with excitement, spreadsheets, and the occasional freakout. But don’t worry; with a little preparation and a few solid tips, you can navigate the journey like a pro.

Matt’s Stats

- Average Down Payment in Ontario: $60,850, which equates to about 7.1% of the average purchase price.

- Interest Rates: Hovering around 4.5% for fixed-rate mortgages (as of December 2024).

- First-Time Buyer Share: About 10% of the Canadian market.

- Incentives: Programs like the First-Time Home Buyer Incentive and tax-free savings accounts can boost affordability.

Budgeting for Your First Home

The golden rule of budgeting for your first home is to leave no expense unexamined. Beyond the sticker price, you’ll need to consider the following:

- Closing Costs: These include land transfer taxes, lawyer fees, and inspection costs—typically 1.5% to 4% of the home’s price.

- Ongoing Expenses: Think property taxes, insurance, utilities, and maintenance.

- The 30/30/3 Rule: Is the 30/30/3 Rule Still Relevant?: Traditionally, the 30/30/3 rule advises spending no more than 30% of your gross income on monthly housing costs, saving for a 30% down payment, and avoiding homes costing more than three times your annual income. However, in Ontario’s current market, this rule has become increasingly difficult to follow.

- Why It’s Challenging:

- Home Prices vs. Income: With the average home price near $900,000 and the average household income around $100,000, sticking to three times your income would cap you at $300,000—far below most market options.

- Down Payment Realities: Saving 30% of $900,000 ($270,000) is unrealistic for many buyers without external financial help.

- Housing Costs: Monthly costs, including mortgage payments, taxes, and utilities, often exceed 30% of gross income.

- Adapting the Rule:

- Focus on personal affordability: Tailor your budget to your unique financial situation rather than rigid rules.

- Leverage government programs to reduce upfront costs and monthly payments.

- Explore more affordable markets or properties that fit your long-term goals.

- Why It’s Challenging:

Canada’s Federal government offers several programs designed to help first-timers break into the market:

- First-Time Home Buyer Incentive: A shared-equity program that helps reduce monthly payments.

- Home Buyers’ Plan: Withdraw up to $35,000 from your RRSPs tax-free to use as a down payment.

- Tax-Free First Home Savings Account: Contribute up to $8,000 annually (up to a $40,000 lifetime limit) for your first home.

Research these programs early to see which ones you qualify for. Your real estate agent and mortgage advisor can also help simplify the process.

Average Down Payment in Ontario

Based on the latest data, the average home price in Ontario is approximately $858,500 as of September 2024. Here’s how down payments typically break down:

- First $500,000: 5% of $500,000 = $25,000

- Remaining $358,500: 10% of $358,500 = $35,850

- Total Minimum Down Payment: $25,000 + $35,850 = $60,850

This equates to about 7.1% of the purchase price for the average Ontario home. However, many buyers aim for 20% or more to avoid mortgage default insurance and reduce monthly payments.

For a deep dive into recent market trends, including affordability stats, check out my always up-to-date look at the Brantford Neighbourhood Median Sale Prices

Pro Tip: As of December 15, 2024, new mortgage rules have increased the insured mortgage limit from $1 million to $1.5 million, enabling buyers to purchase more expensive homes with lower down payments. Consulting with a mortgage advisor can help you navigate these changes.

Why Pre-Approval Matters

Getting pre-approved for a mortgage isn’t just a box to check—it’s a game-changer. Pre-approval locks in your interest rate for up to 120 days, gives you a clear idea of what you can afford, and makes your offer more competitive when bidding on homes.

Actionable Tip: Working with a mortgage broker allows you to compare rates from multiple lenders (a lot of which the banks do not have access to), and don’t forget to ask about hidden fees. Even a 0.1% difference in rates can save you thousands over the life of your mortgage.

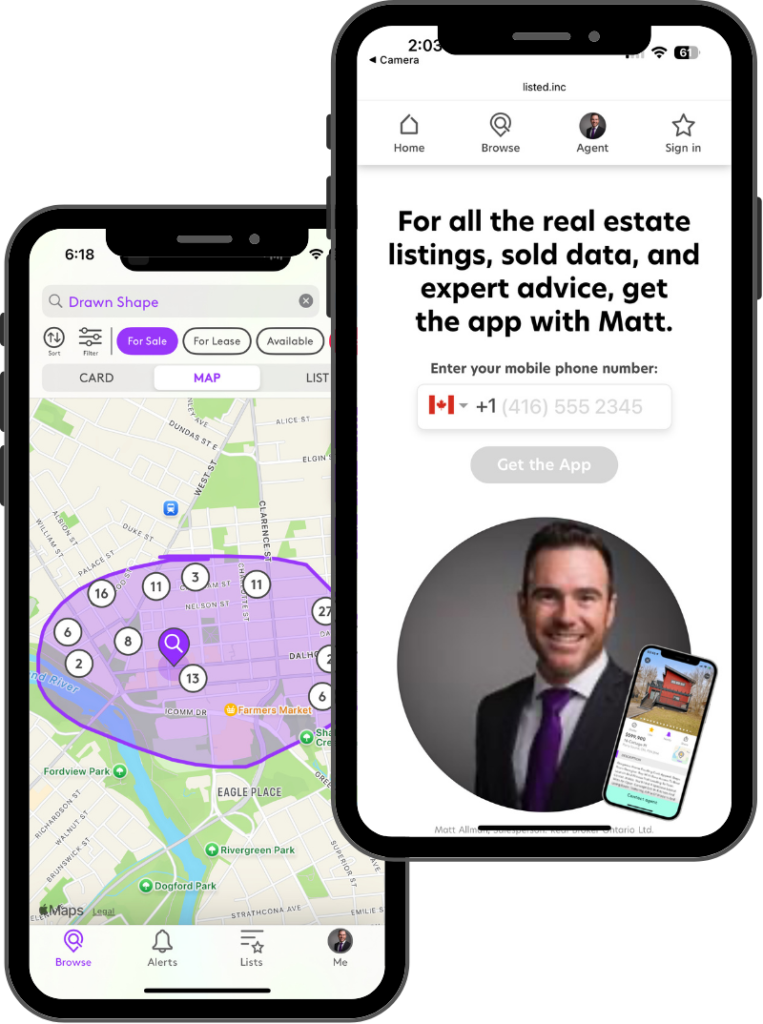

Get new and exclusive listings pushed right to your phone!

Scan the QR code or click the button below to download my app and get access to all the listings in Brantford, Brant County, Norfolk County and all across North America.

It also includes access to exclusive and off-market listings that can only be found on my app!

Download the Listed app today!How Interest Rates Affect Your Mortgage

Interest rates play a massive role in determining how much house you can afford. A 1% increase in rates can reduce your purchasing power by up to 10%.

For example, let’s assume you’re buying a home priced at $625,000 with a 20% down payment ($125,000). This leaves you with a $500,000 mortgage:

- At 5% Interest: Monthly payments are approximately $2,924.

- At 6% Interest: Monthly payments jump to $3,199.

Over the life of a 25-year mortgage, the difference in total interest paid could be well over $80,000. This highlights how even small shifts in rates can significantly impact affordability.

Understanding the Brantford Real Estate Market

Brantford’s real estate market offers a mix of affordability and opportunity, making it a great choice for first-time home buyers. Here are some key points to understand:

- Affordability: Compared to neighbouring cities like Toronto or Hamilton, Brantford’s home prices remain relatively budget-friendly. The average home price in Brantford sits around $600,000 as of late 2024, making it accessible for many first-time buyers.

- Neighbourhood Insights: Popular areas like West Brant offer newer builds with family-friendly amenities, while mature neighbourhoods like Henderson boast larger lots and tree-lined streets.

- Market Trends: Brantford has seen steady growth in sales volume and moderate price increases, reflecting its appeal as a commuter city with a strong community feel. However, inventory levels remain tight, so be prepared to act quickly when you find the right home.

- Future Developments: Upcoming projects, such as new schools and shopping centres, add to the city’s appeal and may boost property values over time.

Pro Tip: Work with a local real estate agent familiar with Brantford’s market to gain insights into the best areas and value opportunities.

Considering Must-Have Features and Location

When searching for your dream home, it’s essential to balance your must-have features with your ideal location. Start by making a list of non-negotiables such as the number of bedrooms, bathrooms, or specific amenities like a yard, garage, or open-concept layout.

Equally important is the neighbourhood. Consider proximity to schools, public transit, grocery stores, and other key amenities. A great home in the wrong location might not be the best fit for your lifestyle.

Pro Tip: Spend time in your desired neighbourhood at different times of the day to get a feel for the community vibe. It’s a small step that can save you from future regrets.

Negotiating Like a Pro

Negotiation isn’t just about price; it’s about value. Use these strategies:

- Understand Market Trends: Is it a buyer’s or seller’s market? Your approach should vary accordingly.

- Don’t Fear Conditions: Including financing or inspection clauses protects your investment.

- Play it Cool: Don’t let emotions drive your decisions. Think long-term.

Pro Tip: For tips on managing tough conversations during negotiations, check out Breaking Bad News to Buyer Clients.

Common Mistakes to Avoid

- Skipping the Inspection: Hidden issues can turn your dream home into a money pit.

- Overextending Your Budget: Leave wiggle room for unexpected costs.

- Ignoring Location: A great home in the wrong neighbourhood is still the wrong home.

- Not Asking Enough Questions: From zoning to future developments, knowledge is power.

Are you ready to make your dream of homeownership a reality? I’d love to hear about your home-buying journey! Whether you just have questions about the local market, or you want to get started on your home search, reach out to me using the form below and we’ll have a chat about your options!