How to Find the Best Condos in Brantford

There are a number of different condominiums in Brantford, but how do we sift through and find the best condos in Brantford with so many factors to consider? Whether you’re a first-time homebuyer, looking for an investment property or downsizing from a larger detached home, understanding the true cost of ownership is crucial. By breaking down the various costs associated with owning a condo, you can find which one provides the most value for what you are paying.

Before we get started, if you are interested in the break down, the geeky nitty gritty of finding the best condos in Brantford, then you can start below.

If you’d like to skip right to the condo rankings from our analysis then you can follow this link.

The Geek Stuff: Finding and Preparing the Data

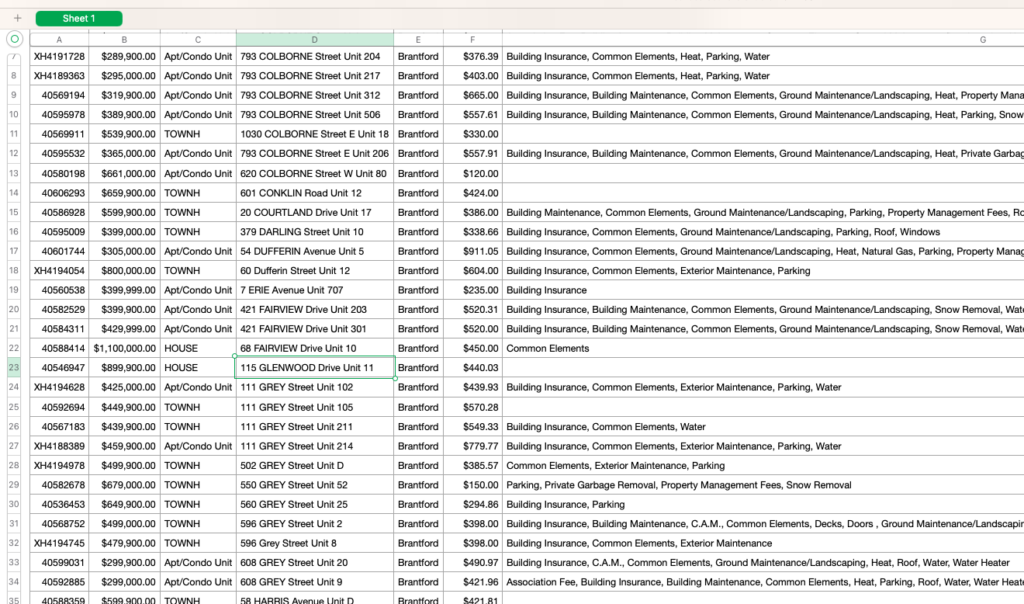

There was a lot of manual parsing of the info from all the listings to make sure we were comparing things on an even playing field. For example, a lot of the condo inclusions and details are just written in free-form in the MLS as a paragraph or a string of text. We needed to go through each condo listing and compile a list of what each address provides as their inclusions.

There were some condo listings that had all the utilities listed separately (Gas, Water, Hydro, etc), and others that just had “all utilities” so we had to comb through and make sure we caught those instances and updated the lists accordingly.

Other data points like square footage also needed some adjustment as some condos had square footage in a finished basement that counts as livable space. Usually only the Above Ground (or “AG”) square footage is listed on the MLS unless there is a separate field or column for Below Ground (or “BG”) square footage.

Calculating Monthly Mortgage Cost to Find the Best Condos in Brantford

Now we were using the active listings as a data set, which means we only had the list prices to go on. Keeping in mind that some of the condos were listed at strategically low prices that were strategic prices to help with their marketing, but we didn’t want to rely on speculation and projected prices, so we eliminated those condos from the list.

Where:

- Loan Amount: Sale price minus the down payment. The down payment is calculated as follows:

- Minimum 5% for homes less than $500,000

- 10% on the amount between $500,000 and $1 Million

- 20% for homes over $1 million.

- Mortgage Insurance: When the downpayment amount is under 20%, mortgage insurance is required and is calculated as follows:

- 3.6% for down payments between 5% and 9.99%

- 2.4% for down payments between 10% and 14.99%

- 1.8% for down payments between 15% and 19.99%.

- Monthly Interest Rate: Annual interest rate divided by 12. For our calculations, we used an annual rate of 5%, so the monthly rate is 5%/12=0.004167 or 4.167%.

- Number of Payments: Total number of monthly payments over the loan period. For a 25-year mortgage, this is 25×12=300 payments.

For example, for a condo priced at $400,000:

- Down Payment:

- Loan Amount: $400,000 – $20,000 = $380,000

- Mortgage Insurance:0.036 x 380000 = $13,680

- Total Loan Amount Including Mortgage Insurance: $393,680

- Monthly Interest Rate: 0.004167

- Number of Payments: 300

- Monthly Mortgage Payment: $2,328.33

Calculating Monthly Utility Cost

Next, we estimate the monthly utility cost based on the condo size and whether the utilities are included in the condo fees. We used very conservative average costs for utilities such as water, heat, and hydro. For our calculations, we used the following average costs:

- Water: $30

- Heat: $50

- Hydro: $60

If a condo does not include any of these utilities in the fees, we add the corresponding cost to the monthly utility cost.

For example, if a condo does not include water and hydro in the fees:

Monthly Utility Cost: $30 (water) + $60 (hydro) = $90

Calculating Total Monthly Cost

To get the total monthly cost of owning a condo, we sum the following:

- Monthly mortgage cost (including mortgage insurance since our downpayment will be under 20%)

- Monthly utility cost (adjusted for included utilities)

- Condo fees

- Property Taxes

Understanding Condo Fees and Reserves

Here in Brantford there are a myriad of amenities and services that condo fees can cover. Among the most common are:

- Common Area Maintenance: Upkeep of shared spaces such as lobbies, hallways, elevators, and recreational facilities.

- Utilities: Depending on the condo, fees might include water, heat, electricity, and natural gas for common areas and sometimes for individual units.

- Building Insurance: Insurance for the building structure and common areas.

- Reserve Fund Contributions: A portion of the condo fees goes into a reserve fund, used for major repairs and replacements, such as roof repairs, window replacements, and exterior painting.

- Property Management Fees: Payment for the services of a property management company that oversees the day-to-day operations and maintenance of the condo complex.

- Snow Removal and Landscaping: Seasonal maintenance such as snow removal in the winter and landscaping in the summer.

- Security Services: Costs for security personnel or systems, if applicable.

Ranking the Best Condos In Brantford

Now there are other considerations like neighbourhood, near by amenities, walking score, etc. that would affect a complete ranking, but this exercise is strictly by the numbers. For these value based rankings we used a comprehensive scoring system that prioritizes the following:

- Total Monthly Cost (TMC)

- Inclusion of utilities and parking in condo fees

- Size of the condo (as a value add)

- Deviation from the median TMC

- Ratio of condo fee and utilities to mortgage cost in the TMC

In ranking the available condos in Brantford, the total monthly cost, encompassing mortgage payments, condo fees, and additional utility costs not covered by the condo fees, is a significant factor. Lower costs naturally should receive higher scores. There is also consideration to value condos that include essential utilities and parking within the condo fees, assigning higher scores to those that offer more inclusive amenities. Additionally, the size of the condo plays a crucial role; larger condos are considered more valuable, thereby scoring higher.

Comparing Apples to Apples

To ensure fairness, we split the list between the townhouse style and the apartment style condos, and then compared each condo’s total monthly cost to the median cost of their respective type. Condos were rewarded with a higher score if they were significantly below the median. This metric is crucial but is balanced with the other factors to provide a holistic view. By normalizing each factor and applying weighted scores, we generated a composite score that accurately reflects the best value options among the townhouses and apartment-style condos.

Condo Recommendations for First-Time Home Buyers

Considerations for First-Time Home Buyers:

- Affordability: First-time home buyers often have limited budgets, so the overall cost (including mortgage, condo fees, and utilities) is a significant factor. Generally, apartment-style condos tend to have lower purchase prices compared to townhouses, making them more affordable.

- Low Maintenance: Condos typically offer lower maintenance responsibilities compared to single-family homes, which is attractive for first-time buyers. Condo fees typically cover many maintenance tasks, including building upkeep, snow removal, and landscaping, reducing the burden on the owner.

- Location and Amenities: Proximity to work, public transportation, schools, and amenities like gyms or pools can be appealing. Many apartment-style condos offer additional amenities such as gyms, pools, and community rooms, which can be attractive for younger buyers and small families.

Best Condo Type for First-Time Home Buyers: Apartment-Style Condos

Top 5 Ranked Apartment Style Condos in Brantford

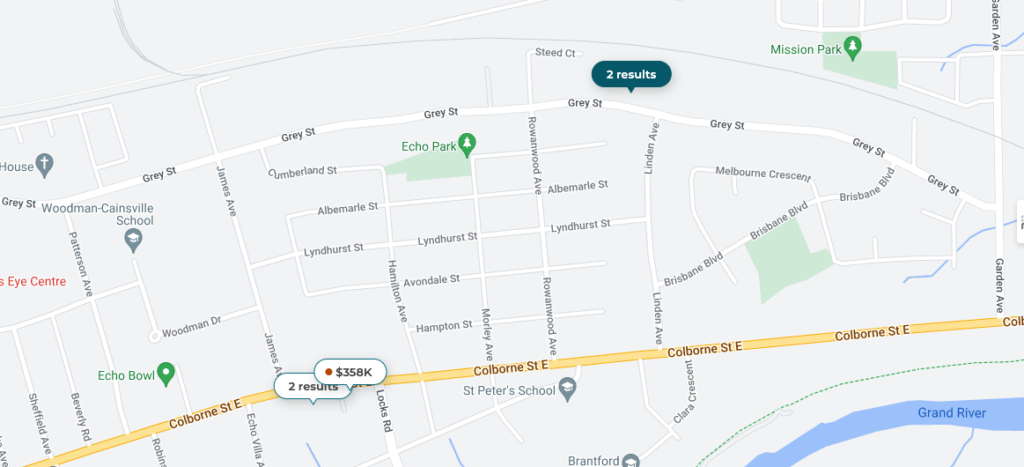

- Address: 793 COLBORNE Street Unit 204

- Listed Price: $289,900.00

- Total Monthly Cost: $2,210.67

- Condo Fees Include: Building Insurance, Common Elements, Heat, Parking, Water

- Deviation from Median Total Monthly Cost: -30.73%

- Address: 793 COLBORNE Street Unit 217

- Listed Price: $295,000.00

- Total Monthly Cost: $2,244.29

- Condo Fees Include: Building Insurance, Common Elements, Heat, Parking, Water

- Deviation from Median Total Monthly Cost: -29.68%

- Address: 608 GREY Street Unit 9

- Listed Price: $320,000.00

- Total Monthly Cost: $2,415.98

- Condo Fees Include: Association Fee, Building Insurance, Building Maintenance, Common Elements, Heat, Parking, Roof, Water, Water Heater

- Deviation from Median Total Monthly Cost: -24.30%

- Address: 7 ERIE Avenue Unit 307

- Listed Price: $387,000.00

- Total Monthly Cost: $2,786.54

- Condo Fees Include: Building Insurance, Building Maintenance, Central Air Conditioning, Common Elements, Ground Maintenance/Landscaping, Heat, Parking, Private Garbage Removal, Snow Removal

- Deviation from Median Total Monthly Cost: -12.69%

- Address: 1 WELLINGTON Street Unit 301

- Listed Price: $349,900.00

- Total Monthly Cost: $2,668.06

- Condo Fees Include: Association Fee, Building Insurance, Building Maintenance, Central Air Conditioning, Common Elements, Ground Maintenance/Landscaping, Property Management Fees, Snow Removal

- Deviation from Median Total Monthly Cost: -16.40%

Total monthly cost includes mortgage (plus applicable CMHC insurance), condo fees, estimated utility fees, and property taxes.

Click the link below for the full ranked list of apartment style condos in Brantford

Brantford Condo Recommendations for Those Looking to Downsize

Considerations for Retirees and Those Downsizing:

- Convenience: Ease of access, single-level living, and minimal maintenance are crucial.

- Community and Safety: A sense of community and security can be important, along with proximity to healthcare facilities. Townhouse complexes often foster a close-knit community environment, providing a sense of belonging and security.

- Comfort and Space: Sufficient space for comfortable living and entertaining visitors. Many townhouses come with private patios or small gardens, which can be appealing for retirees who enjoy gardening or outdoor relaxation.

- Accessibility Options: Many modern townhouses are designed with accessibility in mind, offering features like main-floor bedrooms and bathrooms, which are essential for those with mobility issues or planning to age in place.

Best Condo Type for Those Downsizing and Retiring: Townhouses

Top 5 Ranked Apartment Style Condos in Brantford

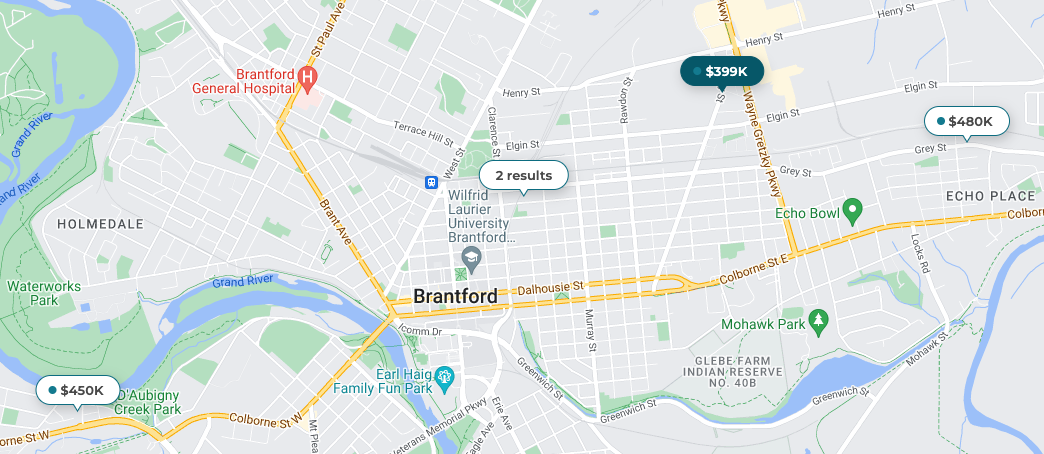

- 271 Stanley Street Unit E

- Listed Price: $399,000.00

- Total Monthly Cost: $2,937.24

- Condo Fees Include: Building Insurance, Common Elements, Exterior Maintenance

- Deviation from Median Total Monthly Cost: -23.68%

- 28 OAKHILL Drive Unit C

- Listed Price: $450,000.00

- Total Monthly Cost: $3,179.83

- Condo Fees Include: Common Elements, Exterior Maintenance, Parking

- Deviation from Median Total Monthly Cost: -17.38%

- 111 GREY Street Unit 105

- Listed Price: $439,900.00

- Total Monthly Cost: $3,465.13

- Condo Fees Include: Building Insurance, Common Elements, Water

- Deviation from Median Total Monthly Cost: -9.97%

- 596 Grey Street Unit 8

- Listed Price: $479,900.00

- Total Monthly Cost: $3,484.81

- Condo Fees Include: Building Insurance, Common Elements, Exterior Maintenance

- Deviation from Median Total Monthly Cost: -9.46%

- 111 GREY Street Unit 211

- Listed Price: $439,900.00

- Total Monthly Cost: $3,395.21

- Condo Fees Include: Building Insurance, Common Elements, Water

- Deviation from Median Total Monthly Cost: -11.78%

Click the link below for the full ranked list of apartment style condos in Brantford

Which Condo In Brantford would be right for you?

We came at this analysis with a strictly numbers/value based approach, but of course there are a few other factors that you should consider when choosing which condo is right for you. Your personal preference in neighbourhood, style, and amenities all play an important role in your final decision. If you’d like to run some questions by me please feel free to do so. Condos are one of my favourite things to dive in to and I’ve helped a number of my clients purchase their first home, or downsize to a condo here in Brantford, and the surrounding areas.

Endnotes

- Mortgage calculations are based on a fixed interest rate of 5% over 30 years.

- Utility costs are estimated based on average values and may vary.

- Condo fee inclusions are derived from the listing data and may differ across properties.

Pingback:Understanding the Condo Status Certificate | Matt Allman - Brantford Real Estate Agent

Pingback:2025 Brantford Housing Market Trends: A Segment-by-Segment Guide | Matt Allman - Brantford Real Estate Agent