Canada’s Rental Market in 2025: What TD’s Latest Report Predicts

The latest report from TD Economics on Canada’s rental market in 2025 has painted a concerning picture for renters in this country. According to TD’s analysis, the affordability crisis in rental housing is expected to persist well into 2025, with limited relief in sight. The report outlines key factors driving rent increases, the role of government policies, and potential market shifts that could impact affordability.

Matt’s Stats: The Key Takeaways

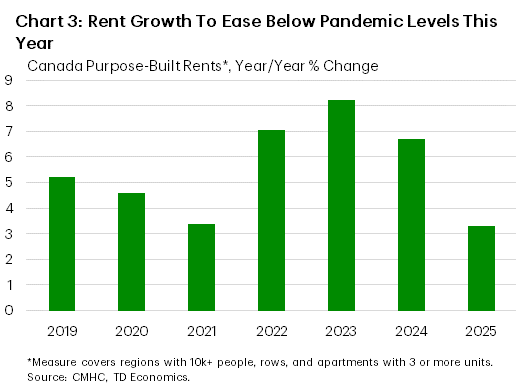

- TD predicts rent increases will continue into 2025, though the pace may slow.

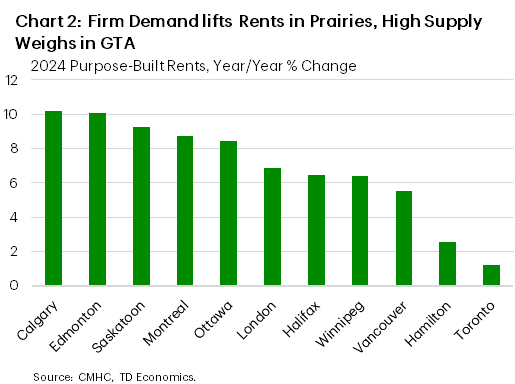

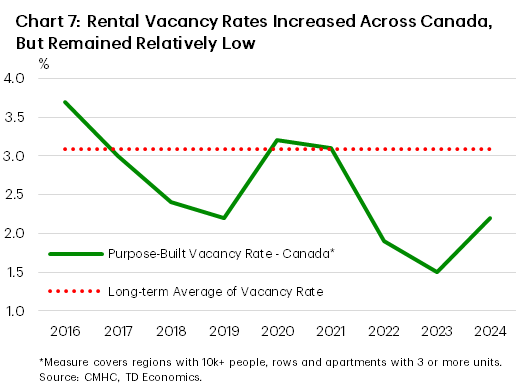

- Vacancy rates remain critically low, particularly in major cities like Toronto, Vancouver, and Montreal.

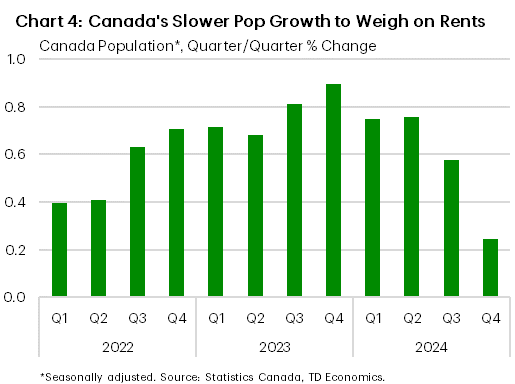

- Immigration, previously a key driver of rental demand, is expected to cool, potentially easing some pressure on rent prices according to TD Economics.

- Government policies, including zoning changes and incentive programs, may help but won’t provide immediate relief.

- Construction slowdowns due to high interest rates could worsen the supply issue.

The Rental Market Crunch: Why Prices Are Staying High

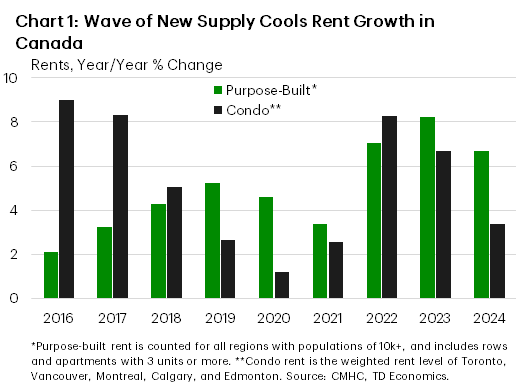

TD’s report attributes rising rents to a mix of economic and demographic factors. Strong population growth, particularly from immigration, has increased demand for rental units faster than supply can keep up. However, TD expects immigration levels to moderate, which could slow the pace of rent increases according to TD Economics.

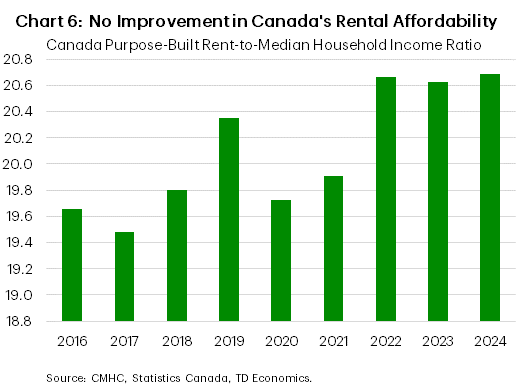

At the same time, higher borrowing costs have deterred new housing development, stalling the construction of much-needed rental stock. The affordability gap is growing as wages fail to keep pace with rent hikes, making it harder for Canadians to afford rental housing. For lower-income households, these trends could mean an increased reliance on subsidized housing or the necessity of moving to smaller units or less desirable locations.

Government Policies: Helping or Hurting?

The federal and provincial governments have attempted to address affordability concerns through various policies. CMHC-insured mortgage changes, expanded rental subsidies, and zoning reforms aim to improve housing accessibility. However, TD’s report suggests these measures may have short-term inflationary effects, potentially pushing rents even higher before they bring meaningful relief.

Municipalities, particularly in high-demand urban centres, are also revisiting rent control laws and incentive programs to spur the development of rental units. However, developers remain hesitant to build due to high interest rates and uncertainty in the market.

Where Does Supply Stand?

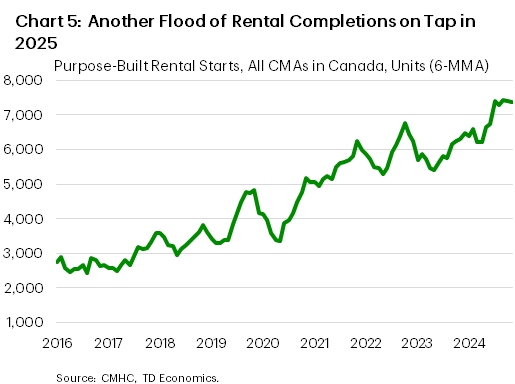

Rental supply remains far below demand, with TD estimating that Canada needs millions of new units over the next decade to stabilize prices. However, construction activity is slowing down, with fewer rental buildings breaking ground due to financial constraints.

Condo investors, traditionally a significant source of rental supply, are also feeling the pinch of high mortgage rates. Many are offloading properties, shifting more demand onto an already strained rental market.

The 2025 Rental Outlook: What Renters Can Expect

TD’s outlook for Canada’s rental market in 2025 remains challenging for renters:

- Rents will continue rising, but the rate of increase may slow if economic conditions soften.

- Job market stability will play a major role—unemployment spikes could cool demand slightly.

- Immigration levels will be lower than previous years, which could ease some rental market pressure according to TD Economics.

- Policy changes, such as increased rent controls or incentives for developers, could shift the balance in localized markets.

- Rental turnover should also upwardly pressure rents this year, although perhaps not to the same extent as recent years.

What about Looming US Tarrifs?

This forecast assumes continued economic and job growth as a baseline. While the impact of U.S. tariffs has been factored into projections, there is an increasing risk that their effects could be more severe than anticipated. If tariffs are broader, prolonged, or met with significant retaliation from Canada, the rental market could respond differently than expected. In such a scenario, rent growth may stagnate or even decline, potentially resulting in the weakest rental market conditions since the early 1990s.

Final Thoughts on Canada’s Rental Market In 2025: What Can Be Done?

With affordability at crisis levels, TD’s report suggests that policy interventions must be bold and strategic. Expanding rental supply is the clearest solution, but without incentives for developers and a reduction in borrowing costs, new builds will remain scarce. Renters, in the meantime, will need to navigate a tight market with few affordable options.

As Canada moves into 2025, the rental market remains one of the most pressing economic and social challenges. If you’re a renter or an investor wondering how this will impact your plans, reach out—I’d love to hear your thoughts and help you navigate the evolving market.