Fall Brantford Real Estate Market : A Transformation

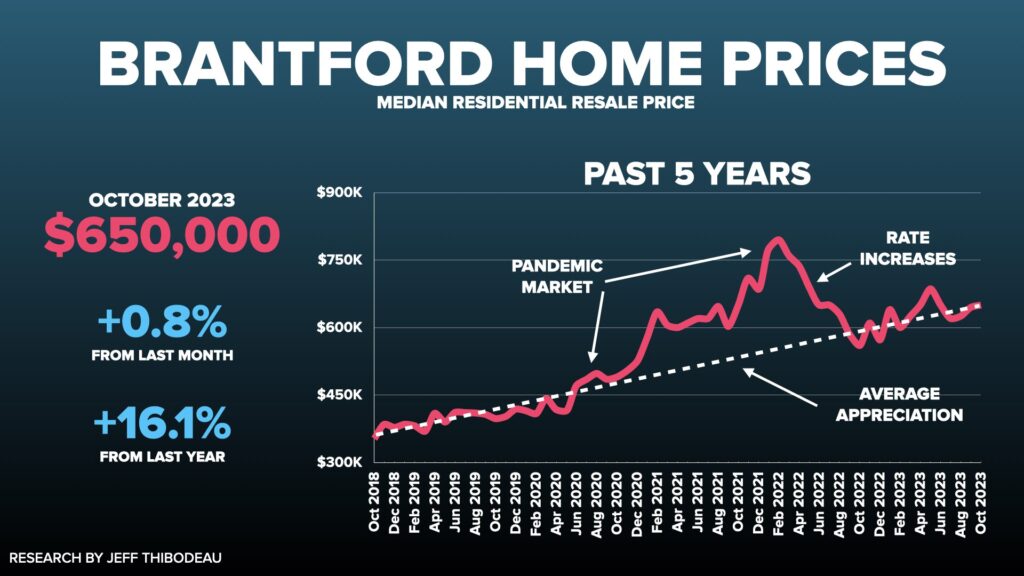

The Fall Brantford Real Estate market is a mix bag that has been affected by economic changes, and evolving buyer preferences. As we delve into the figures for October, we see the median sale price of residential homes continuing its upward journey, reaching $650,000. This steady increase comes amidst shifting interest rates and the market’s recovery from the impact of the Bank of Canada’s previous rate hikes. Despite this robust year-over-year price growth, the market maintains a sense of equilibrium, with a significant number of sales occurring for homes under $800,000 and properties listed for less than six weeks showing the highest turnover. Throughout the region, distinct conditions prevail, with seller-friendly markets to the north and more buyer-oriented environments elsewhere. Let’s dissect the data by neighbourhood, property type, and price range to reveal unique market segments that will capture the interest of homeowners, buyers, and sellers alike.

Key Insights

📈 The median sales price continued its upward trajectory, reaching $665,000 in October, indicating a strong real estate market despite interest rate increases and pauses.

📈 The price pressure continues to push up, probably where it should have been if we didn’t have this crazy low interest rate environment followed by the super high demand and people wanting to move during the pandemic.

🏡 The trend of people moving from the GTA and KW region to Brantford for more square footage is continuing.

💰 The dollar per square foot indicator reveals that West Brandt, with high median sale prices, is actually quite affordable on a dollar per square foot level due to smaller lots but bigger houses.

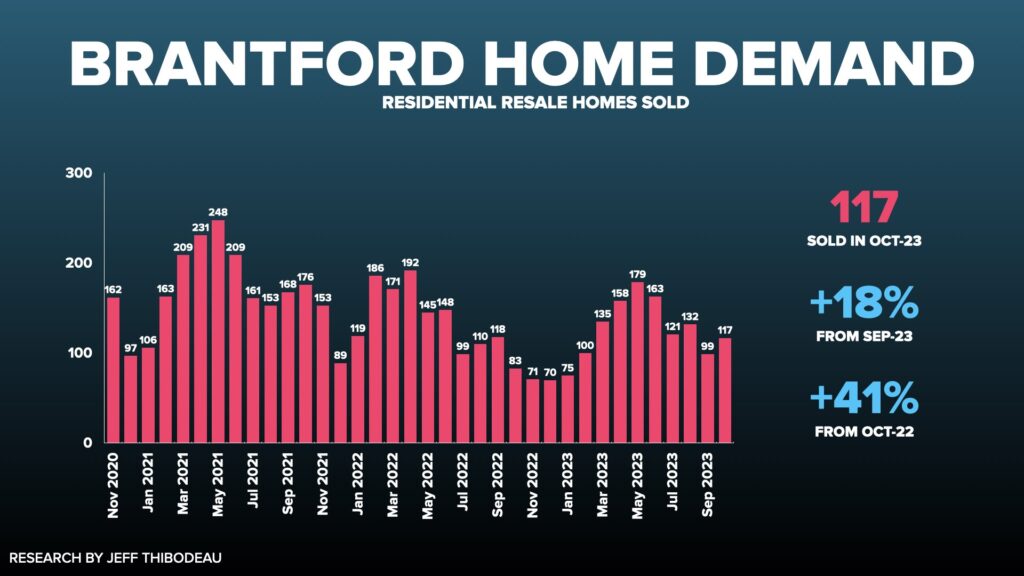

📈 The 18% increase in homes sold in October shows a significant surge in demand, putting pressure on the real estate market.

📈 The real estate market inventory in Brantford is up 41% compared to last year, despite a 7% decrease in the number of homes sold.

Buyer Opportunities and Strategies

🏡 The window to buy is wide open right now for the winter months to snag a deal and lock in at prices which may not be returning anytime soon.

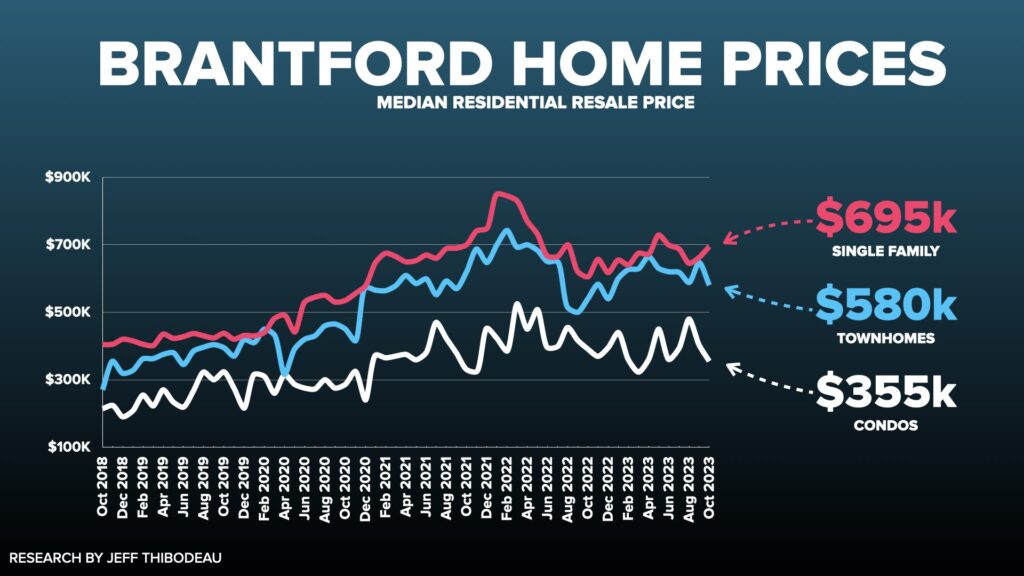

💰 Condos are becoming more popular in Brantford, with apartment-style condos as the new style of development, offering a great way to get into the real estate market at an average price point of $355,000 for the median condo.

🤑 There’s a significant opportunity for buyers in the condo market, especially because condos are more affordable and buyers can negotiate a great deal.

🏡 For the listings over $800,000, the market shifts completely, giving buyers with a budget over $800,000 more negotiating power and choice.

October: The Resilient Fall Brantford Real Estate Market

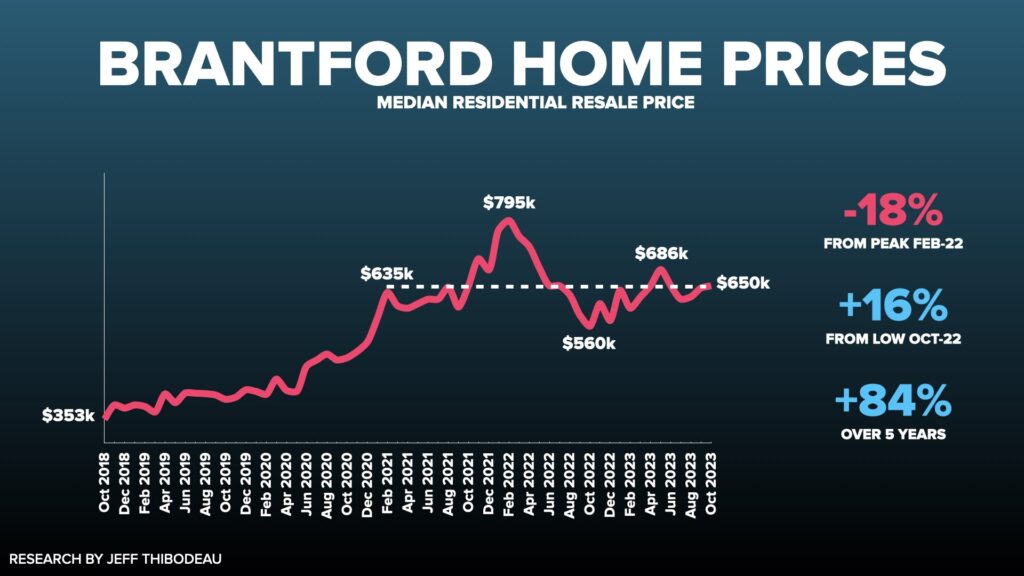

In October, Brantford’s residential resale homes achieved a median sale price of $650,000, reflecting a steady 0.8% increase from September and an impressive 16% rise from the previous October’s low point. This rebound follows the pattern established during the pandemic when high demand and low-interest rates propelled prices upwards, only to decline significantly with the Bank of Canada’s interest rate hikes in 2022. Remarkably, since October 2022, median sale prices have been consistently rising despite persistent high-interest rates.

While the current median sale price is 18% lower than the peak observed in February 2022, it has rebounded by 16% from the recent low in October 2022.

Property Type Trends

Brantford’s detached homes lead the market with a median sale price of $695,000, closely followed by townhomes at $580,000. If you’re seeking more affordable options, condominiums present the lowest median price at $355,000.

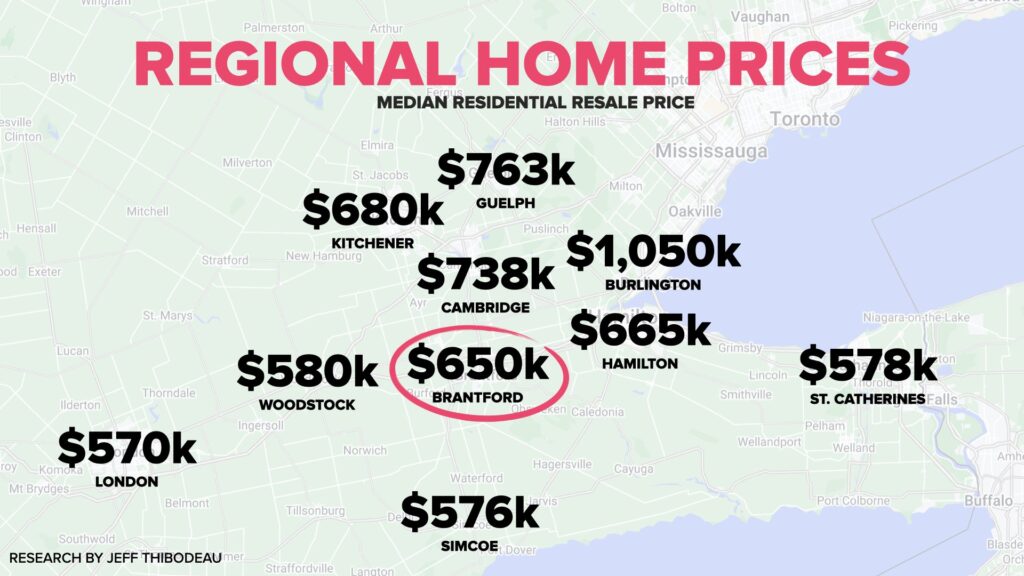

Affordability and Comparisons of the Fall Brantford Real Estate Market

Brantford stands out as one of the more affordable choices in close proximity to the Greater Toronto Area (GTA). Median residential home prices in Cambridge are 14% higher and 17% higher in Guelph. As you move west, a comparable home in Burlington costs 62% more, with prices escalating even further as you approach Toronto. Greater affordability is often found as you venture farther from the GTA

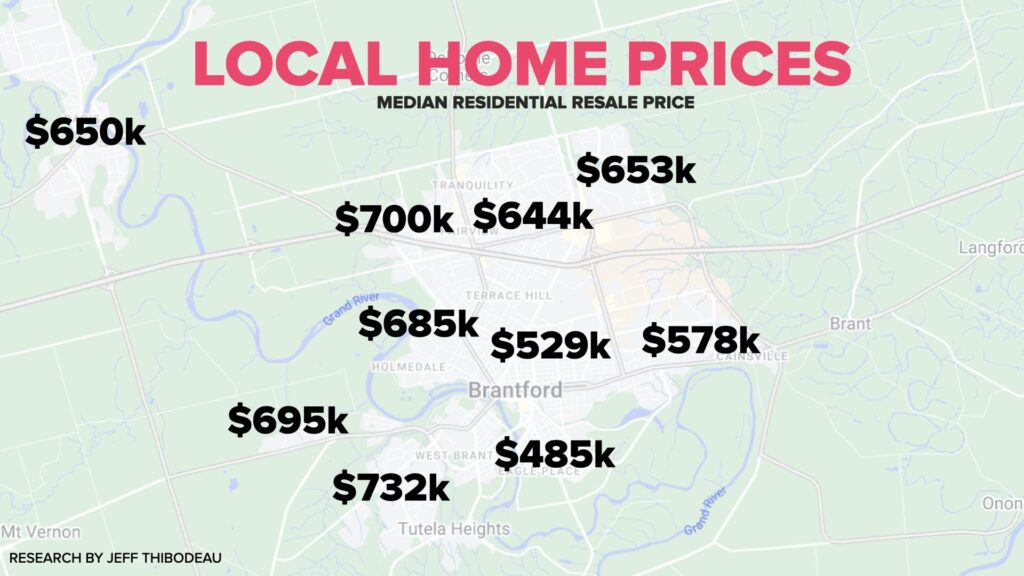

Neighborhood Price Variations

The pricing landscape in Brantford varies significantly by neighbourhood. Areas north of Highway 403 command higher prices due to consistent buyer demand. The “West Brant” neighbourhood, known for its larger and newer homes, boasts the highest median sale price. The Henderson & Holmedale area, situated west of downtown and east of the river, is esteemed for its historic character and carries a premium price. If you’re looking for affordability, the central region north and east of downtown provides more budget-friendly options, while Eagle Place, to the southeast, offers the most cost-effective neighbou rhood.

Evaluating Value: “Dollar per Square Foot”

Assessing the “dollar per square foot” metric can provide valuable insights into the value of specific neighbourhoods. A lower figure suggests that you’re getting more living space for your money, indicating larger living areas at an economical price point. Conversely, a higher number implies that you’re paying a premium, often due to the desirability of the area, which typically includes larger lot sizes.

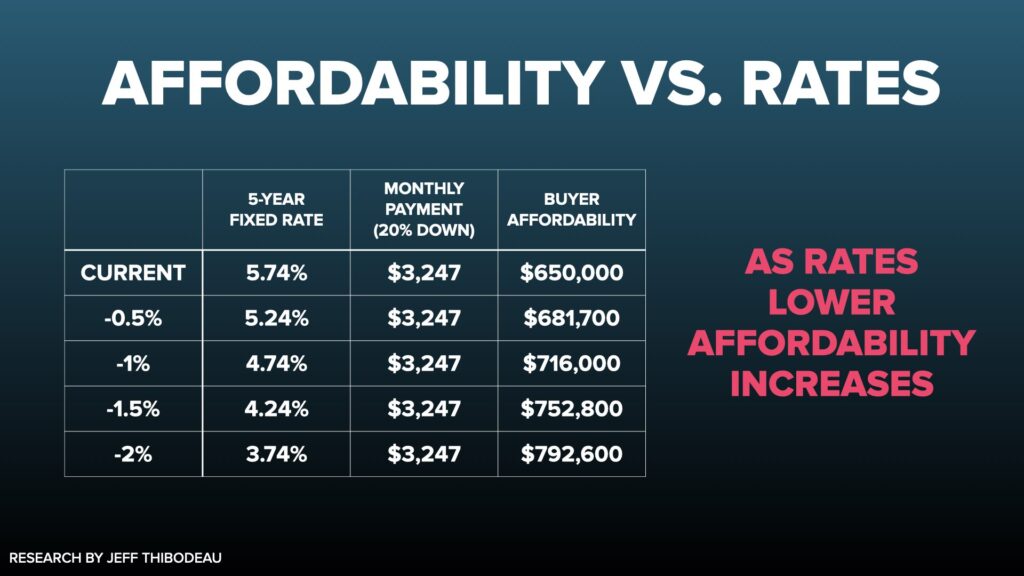

Interest Rates and Impact on the Brantford Fall Real Estate Market

The Bank of Canada’s decision to maintain interest rates on October 25 came as a relief to home buyers and variable mortgage holders, marking the second consecutive rate hold. Many economists interpret this as a sign that the era of rate hikes may be coming to an end, with expectations leaning towards a potential rate reduction by 2024. Any decrease in the qualifying interest rate would immediately enhance borrowers’ affordability, allowing them to qualify for a larger loan with the same monthly payment. Given the persistent supply-demand imbalance in our market, any dip in interest rates is likely to quickly boost demand and drive prices upwards.

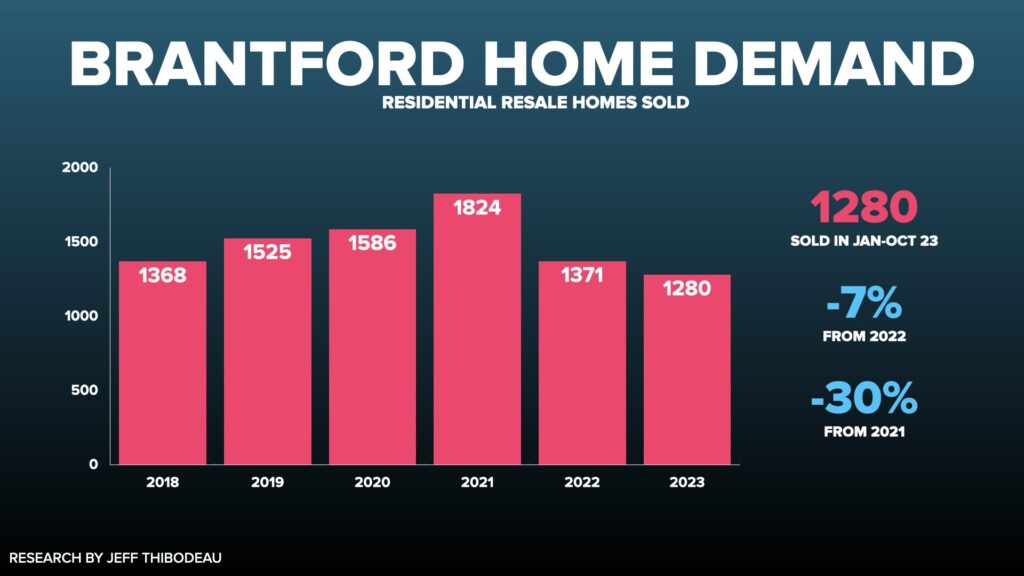

Sales and Demand

Home demand in Brantford picked up in October, with sales increasing to 117 homes, marking an 18% rise from the previous month and a remarkable 41% surge from the same period last year. However, year-to-date figures reveal a 7% decrease in home sales compared to the previous year, with a substantial 30% drop from the peak demand experienced in 2021.

Supply and Market Balance

The influx of new listings in Brantford’s market saw a notable decline in October, with only 245 homes entering the market—a 15% decrease from September. However, this figure represents a 48% increase compared to last October, when the market witnessed an unusually early onset of winter real estate activity. So far this year, Brantford’s MLS system has registered 2,324 new listings, marking a 6% decrease from the previous year yet a slight 3% uptick from 2021. This overall reduction in both supply and demand has contributed to a balanced market dynamic.

Listing Strategies and Market Response

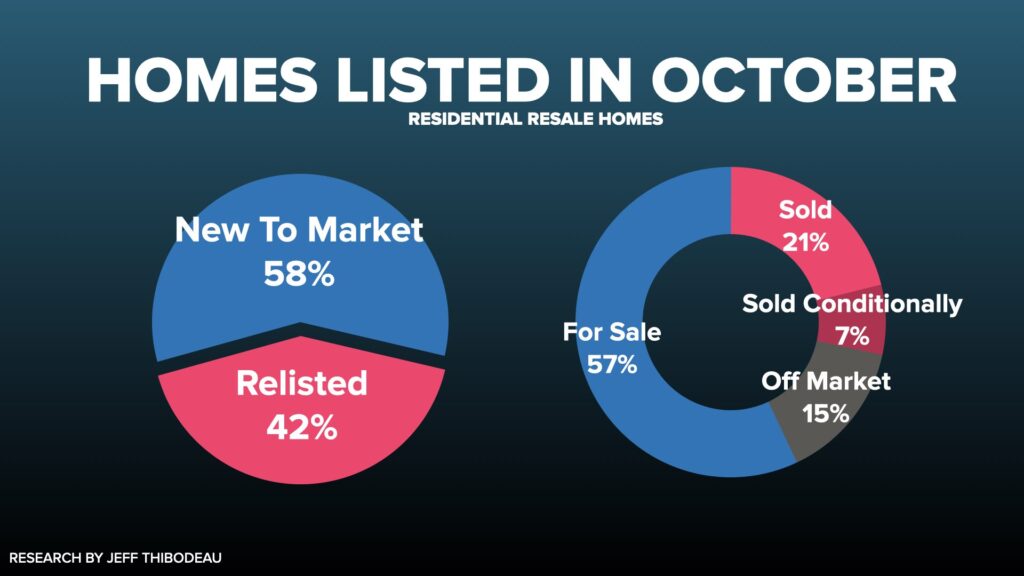

In October, a significant 42% of homes classified as “new” listings in Brantford had previously been listed and did not sell. This practice can give a misleading impression of the actual number of new listings. Furthermore, of the homes listed in October, 28% sold, and 15% were removed from the market, with some being relisted and others withdrawn from sale entirely. This indicates market activity where sellers are adjusting strategies in response to buyer behavior and market conditions.

Inventory and Market Shifts

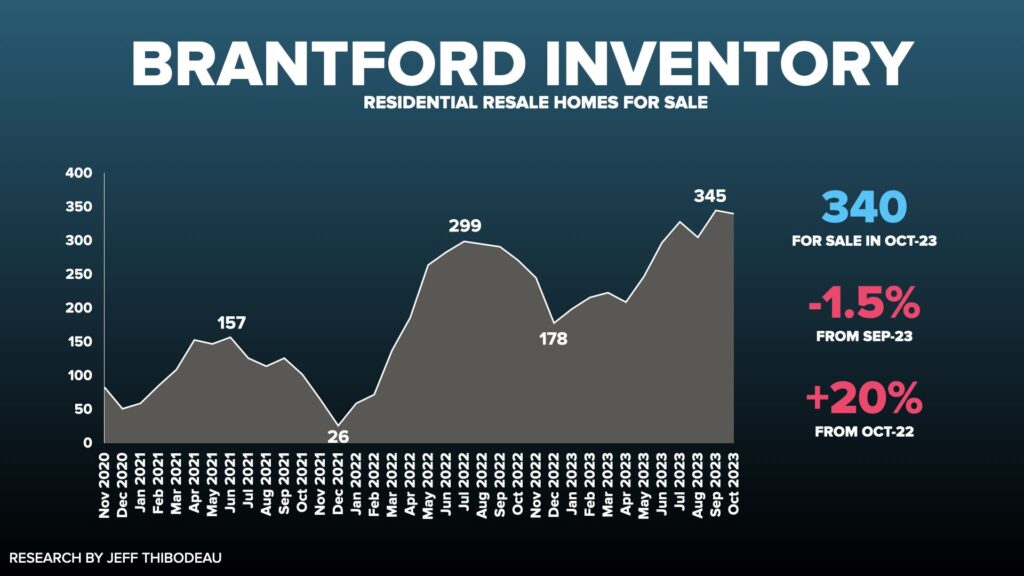

In October, the average number of homes on the market in Brantford was 340, representing a 20% increase in inventory compared to the previous October. This marks a significant shift from the market conditions experienced in 2021, which saw inventory levels fluctuate between a high of 157 and a low of just 26 homes for sale. Current trends suggest that inventory levels are likely to decline from this point until January 2024.

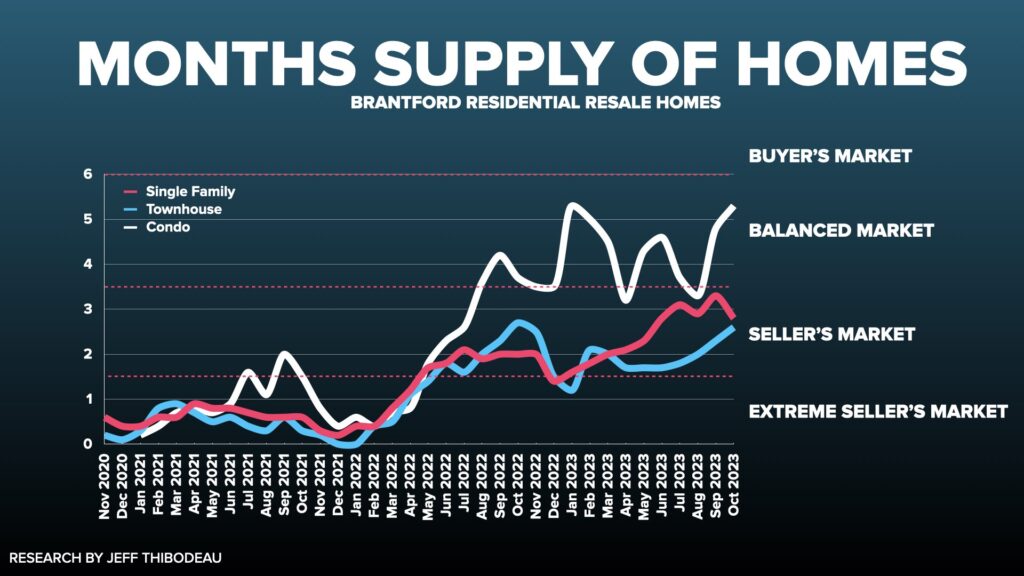

Market Balance: Months of Supply

The “months of supply” metric provides insight into the balance between supply and demand in the real estate market. A lower number indicates a seller’s market, characterized by high competition among buyers and quickly absorbed inventory. Conversely, a higher number suggests a buyer’s market with more available inventory and less competition.

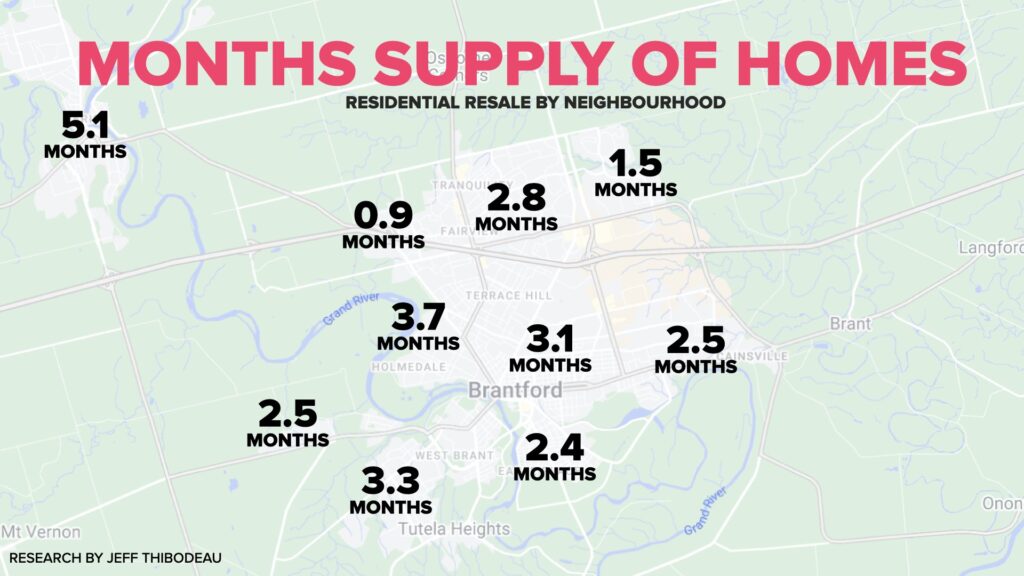

In September, the months of supply reached a peak at 3.2, signaling a trend towards a buyer’s market. However, it decreased to 2.9 in October, indicating a slight shift back in favor of sellers, as inventory moved more quickly due to increased demand. The months of supply differ across the region, with cities north of Brantford experiencing a seller’s market and those in other directions leaning towards a buyer’s market.

Neighbourhood Variations

Within the city, the months of supply vary significantly between neighborhoods. The northwest neighborhood of Myrtleville-Mayfair is a seller’s market, characterized by low supply and high demand, making it competitive for buyers. In contrast, the southwest neighborhood of West Brant offers more options for buyers, who face less competition. Notably, the town of Paris is edging towards a buyer’s market, with a months supply of 5.1, suggesting buyers there have more leverage and a greater selection of homes from which to choose, with less urgency to make quick decisions.

Segmentation by Price Point

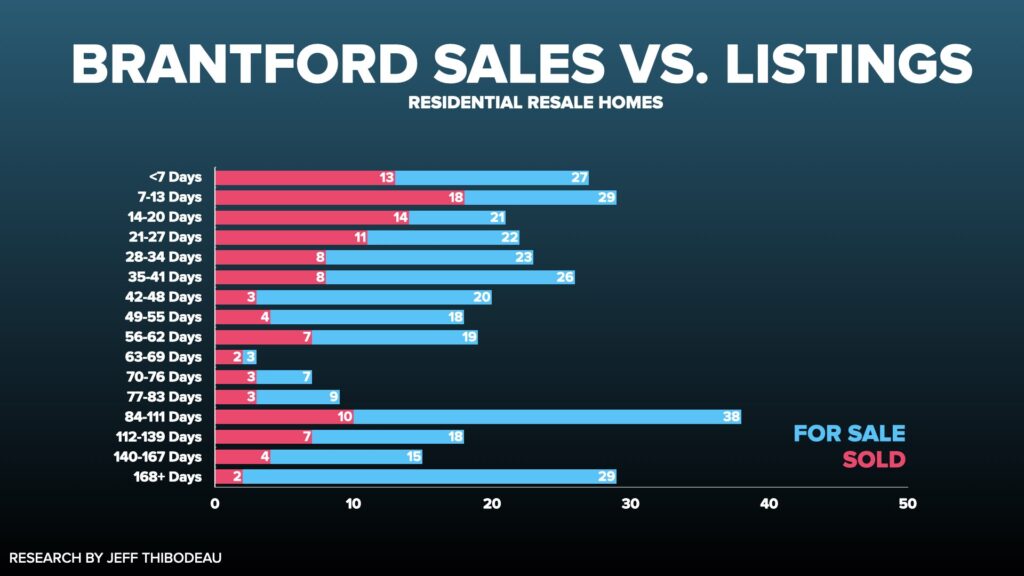

Analyzing the market by the duration properties have been listed offers valuable insights. A notable 62% of all sales occur with properties that have been on the market for six weeks or less, indicating a brisk turnover for newer listings. On the other hand, there is a considerable inventory of properties that have been listed for 12 weeks or more, suggesting these homes are not aligning well with buyer demands, possibly due to pricing, condition, location, or other factors that make them less desirable in the current market.

Market Competitiveness

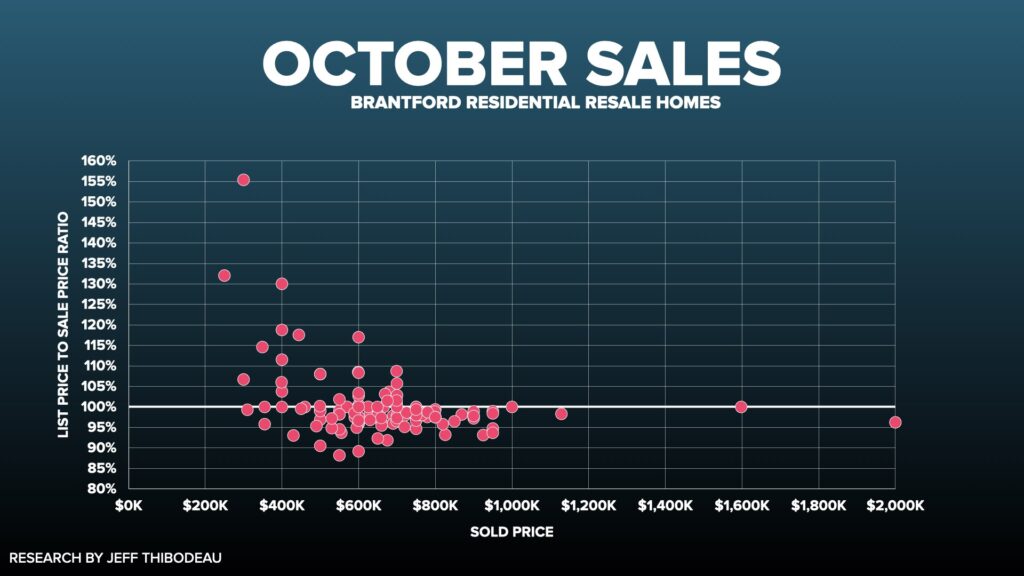

The list-to-sale price ratio is a metric that provides insight into the competitiveness of the housing market. A ratio of 100% means that homes are selling at their listed asking price. Ratios above 100% indicate homes are selling for more than the asking price, often due to bidding wars or high demand. Conversely, ratios below 100% mean homes are selling for less than the asking price, which can be due to various reasons such as less demand, pricing above market value, or other negotiable factors in the sale.

For In October, the data indicates that 36% of residential property transactions took place at the asking price or higher, highlighting a market in which more than one-third of homes are in high demand or competitively priced. Conversely, 64% of houses were sold below the asking price, suggesting that the majority of buyers are able to negotiate, and sellers may be adapting to market conditions that are not as fiercely competitive as they were in the past.

Market Dynamics and Timing

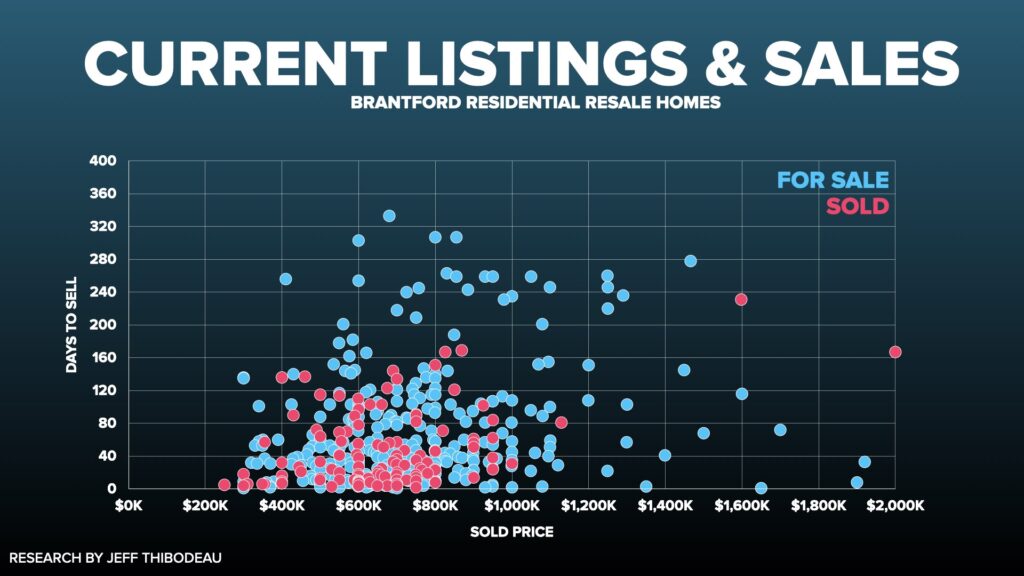

A visual representation of currently available homes (depicted in blue) compared to the most recent month of sales (depicted in red) clarifies the most dynamic segments of the market. Homes priced under $800,000 and those listed for less than six weeks are seeing the most activity, emphasizing the importance of competitive pricing and fresh listings in attracting buyers.

This visual also highlights a clear trend: the longer a home remains on the market, the lower its likelihood of selling becomes. This could be a signal to sellers that pricing strategies and home presentation need to be optimized for quick sales, and that lingering on the market may lead to a less favorable sale outcome.

Navigating the Brantford Real Estate Market

The Brantford real estate market in fall is both a collection of opportunities and a collection of it’s own challenges, favouring buyers in some sectors and rewarding sellers in others. Buyers should act decisively on properties priced under $800,000 and those newly listed, as these segments exhibit the highest levels of competition and liquidity. Sellers should be mindful of the market’s sensitivity to pricing and listing duration; homes that linger on the market beyond six weeks tend to lose momentum. To optimize your position, whether buying or selling, tailor your strategy to align with these nuanced market dynamics.

Given the complexity of the current real estate landscape, individual circumstances can significantly impact outcomes. I encourage you to engage with a seasoned professional for personalized guidance. Don’t hesitate to contact me to discuss how we can navigate the market together to meet your specific real estate goals and leverage the latest trends for your benefit.